Contents(Click to jump)

LLC CLASS offer (49$) or 5 detailed questions for 29$ or free 15 minutes consult include in Doola Package

Before forming and operating, use a 30‑minute CPA session to lock the optimal path: Purchase consultation

- State selection & address: balance privacy, cost and compliance

- Tax registrations & filings: federal/state taxes, sales tax, withholding cadence

- Banking & documents: EIN, BOI, opening kits & common pitfalls

- Cross‑border compliance: bookkeeping, invoicing & annual obligations

Outcome: one professional session avoids costly rework & penalty risks, improves speed to launch.

Non‑US residents can compliantly set up a US company, optimize tax & banking path, with a dedicated account manager and localized support. Comparison table

Full service package

Original total $401 ($297 + ~$104 state fee, Wyoming)

Includes Mercury account $250 cashback tips

- ✓LLC CLASS offer (49$) or 5 detailed questions for 29$ or free 15 minutes consult include in Doola Package

- ✓Full company formation agency: language‑specific support for all steps

- ✓EIN application handled by dedicated account manager

- ✓Bank account pathway: assist opening Mercury business account (98% first‑pass)

- ✓Annual bookkeeping & tax filing: optional via platform

- ✓Compliance safeguards: multiple compliance aids & reminders

- ✓US registered agent & business address

Full Comparison: 6 Service Providers

Pricing and services at a glance (summarized from detailed article).

| Provider | Formation Fee | EIN | Registered Agent | Banking Help | Tax Support |

|---|---|---|---|---|---|

| Doola | $223 (25% off) | Included | Included | Mercury assist (98% pass) | Included (30 min) |

| LegalZoom | $297+ | Add‑on | Add‑on | Limited | Limited |

| ZenBusiness | $199+ | Add‑on | Included | Limited | Optional |

| Breeze | $149+ | Add‑on | Included | Limited | Optional |

| Northwest Registered Agent | $225 | Add‑on | Included | Limited | Optional |

| IncFile | $0 / $199 (tiered) | Package dependent | Included | Limited | Optional |

Note: State fees vary by state (Wyoming shown as reference). Details in the article below.

Contents

Ultimate Guide for Non-US Residents: Start Your US LLC + Bank Account for Just $17 (excluding state fees) + Free 15-minute consultation

Talent Is Everywhere, But Opportunity Is Not | Equal Access Starts Now!

Hey, fellow entrepreneurs from around the world!

I'm Sara Parker, founder of llcclass.com. Like many of you, I deeply understand a harsh reality: talent is everywhere, but opportunity is highly concentrated.

The image below shows the reality for many people today—managing users, purchases, and global payments through Stripe to serve customers from all over the world.

You might be a brilliant programmer in Berlin, a service provider in France or Africa, a trader in Dubai, an engineer in China, an anime creator in Japan, a beauty professional in Korea, a creative designer in Buenos Aires, an e-commerce expert in Bangalore, or a content creator in Taipei. You have ideas, skills, and passion—but you're blocked from the world's largest market by an invisible wall.

This wall is called: The barrier to entry into the US financial ecosystem.

- Want to accept payments with Stripe? Sorry, your country isn't supported.

- Want to sell on Amazon? You need a US company.

- Want to gain investor trust? Without a US entity, it's difficult.

- Want to integrate Shopify Payments? Sorry, US businesses only.

Enough! This inequality must end.

This is why I created llcclass.

llcclass's Mission: Make Opportunity as Ubiquitous as Talent

llcclass's mission is simple yet ambitious:

Help global entrepreneurs transform their dream ideas into dream careers, gain equal access to the US financial ecosystem, and become successful solo entrepreneurs and one-person companies in the AI era.

We believe that in the AI age, one person is a company. You don't need a large team, expensive office, or millions in startup capital. You only need:

- ✅ A good idea

- ✅ The right tools

- ✅ Access to the right markets

And that last point—access to the US market—is exactly what llcclass solves for you.

Our vision is: Enable anyone, anywhere in the world, to start and scale a business as easily as clicking a button. Single-handedly drive the global entrepreneurial revolution in the AI era.

To fulfill this vision, I've written a series of articles, including this one: [How to Register a US LLC - Complete Overseas Guide for $199 Agent Registration Including Address](LLC Class)

Today, I'll show you how for just $17 (excluding state fees), you can break down this wall and gain:

- ✅ A legitimate US LLC company

- ✅ A powerful US bank account

- ✅ Access to top payment systems like Stripe, PayPal, and more

- ✅ Eligibility to sell on Amazon, Etsy, and other platforms

- ✅ Equal competitive standing with US-based businesses

No US citizenship required, no expensive lawyers needed, no complex processes. Just the right guide and combination of tools.

This isn't theory—this is the real path I'm personally taking. Today (October 21, 2025), I will begin my registration process and document every step to share with you.

How It All Started: My Story

As an international founder, I deeply understand the pain of breaking into the US market:

Complex processes like a maze: Which state is best? What documents are needed? How to apply for an EIN? Every forum and blog says something different, leaving you lost.

Address and registered agent: You must have a US address and registered agent—where do you find this? Randomly choosing a service provider makes you worry about reliability.

Bank account opening harder than climbing to heaven: Traditional banks like Chase and Bank of America require you to appear in person or have an SSN/ITIN. For non-residents, this is nearly impossible.

Hidden fees and expensive lawyers: It looks cheap at first, but every step costs extra. Hire a lawyer? Just a consultation costs thousands of dollars, and success isn't guaranteed.

I spent weeks researching, comparing over a dozen service providers—LegalZoom, ZenBusiness, Stripe Atlas, Northwest Registered Agent, Incfile—reading hundreds of Reddit posts and Trustpilot reviews.

Eventually, I not only found the answer but discovered an amazing combination that makes the entire process nearly free.

Yes, you read that right. With the right service combination and exclusive offers, you could end up spending only about $17 (excluding state fees) to have a compliant US LLC and a powerful US bank account.

Let me share this secret with you.

Step One: Why a US LLC Is Essential for AI-Era Solo Entrepreneurs

In the AI age, one-person companies are becoming mainstream. You can use ChatGPT to write content, Midjourney to design images, automation tools to manage customers, and AI to handle finances—one person can do what previously required 10 people.

But there's one bottleneck: payments and market access.

This is why a US LLC is so critical for international founders:

1. Complete Access to US Payment Systems

Seamlessly use top payment processors: Stripe, PayPal, Shopify Payments, Square—these tools are simply unavailable in many countries, or they have strict restrictions and high fees.

With a US LLC, you magically go from "not supported" to "welcome aboard." You can:

- Process payments in 135+ currencies with Stripe

- Accept all major credit cards without third-party intermediaries

- Enjoy much lower fees than local payment processors

- Get advanced fraud protection and dispute resolution

What does this mean? If you're doing SaaS, online courses, digital products, or subscription services—you can finally accept payments from global customers just like US entrepreneurs.

2. Easy Access to US Marketplace Platforms

Amazon FBA, Etsy, eBay, App Store, Google Play—these platforms either require a US entity or have clear policy advantages for US sellers.

With a US LLC:

- You can sell on Amazon as a domestic seller with lower fees and higher trust

- You can reach the US handmade market on Etsy

- You can more easily pass App Store and Google Play reviews

- You can participate in US affiliate marketing programs and earn higher commissions

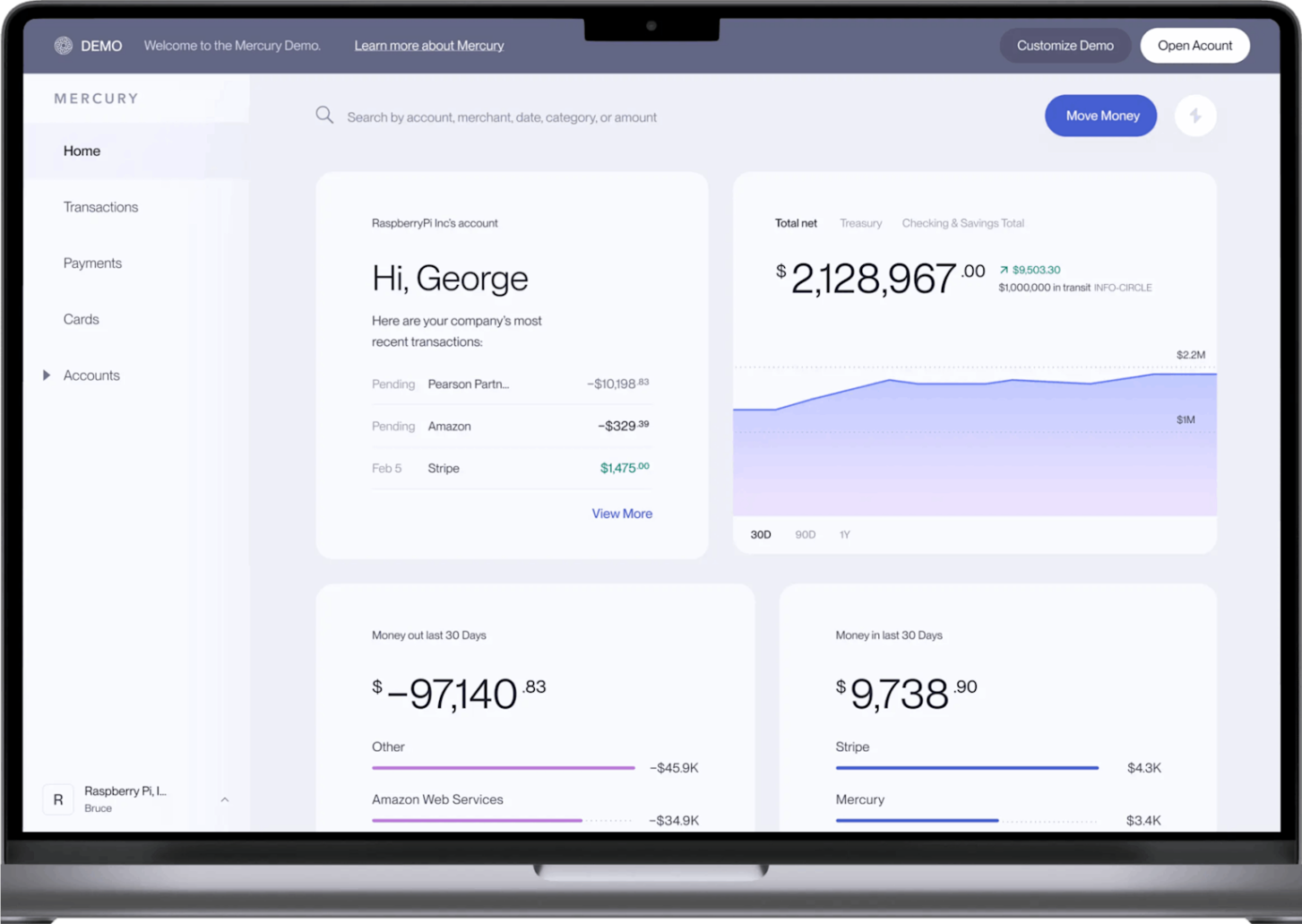

3. Open Powerful US Digital Bank Accounts

Mercury, Wise, Relay—the new generation of digital banks designed for tech companies and e-commerce businesses, offering features traditional banks can't match:

- Zero monthly fees, no minimum deposit requirements

- Free USD international wire transfers

- Virtual and physical debit cards

- Seamless integration with accounting software (QuickBooks, Xero)

- Powerful APIs for automation

- Team member permission management

- Real-time transaction notifications

Comparison: If you use a local bank to receive international payments, you could be charged $20-50 in intermediary bank fees per transaction, plus 3-5% currency conversion fees. Mercury's international wires are completely free, with only 1% currency conversion.

4. Enhanced Global Business Credibility

Psychological fact: When customers see a ".com" domain, US business address, and US phone number, trust increases immediately.

It's not fair, but it's reality. America's business legal system is globally recognized as one of the most mature and reliable. Having a US LLC is like having a global business trust passport.

This is especially important for B2B service providers:

- US business clients prefer to contract with US entities

- In contract disputes, the US legal framework is clearer

- When issuing invoices, a US EIN is more professional than a personal identity

5. Limited Liability Protection

LLC stands for "Limited Liability Company."

This means:

- If your company is sued, plaintiffs can only pursue company assets, not your personal property

- If the company owes debt, creditors can't seize your private home or savings

- Your entrepreneurial risk is contained at the company level

Especially important in the AI age: When testing new ideas and rapidly iterating products, this protection lets you boldly experiment without worrying that one failure will destroy your personal finances.

6. Major Advantages Without Needing US Status

The best part: you don't need to be a US citizen, don't need US residency, and don't need an SSN.

As a non-US resident:

- You can 100% legally own and operate a US LLC

- You can complete all processes remotely without ever setting foot in the US

- If your income source is outside the US, you may not need to pay US income tax (only report)

- You can enjoy all advantages of a US LLC while maintaining tax residency in your home country

This is why:

- Without LLC: "Sorry, your country isn't supported"

- With LLC: "Welcome! Please start accepting global payments"

Once you cross this threshold, the world becomes completely different.

You transform from "an international freelancer excluded from the system" to "a global player competing equally with US businesses."

This is what llcclass exists for: to help you cross this threshold and gain equal access to the US financial ecosystem.

This is the fastest overall speed available for international founders on the market.

Why not choose other service providers?

Full comparison of six mainstream registered agents

To help you make the best decision, here’s a detailed comparison of 6 mainstream LLC registration services’ pricing, services, and suitability:

| Item | Doola | LegalZoom | ZenBusiness | Northwest | Incfile | Stripe Atlas |

|---|---|---|---|---|---|---|

| Base formation fee | $297/year | $0–79 | $0–49 | $225 | $0–299 | $500 |

| Registered agent (first year) | Included | Free (then $299/yr) | $199/yr | $125/yr | $119/yr | Included |

| EIN application | Included | $79 | $70 | DIY | DIY | Included |

| Operating Agreement | Included | $99 | $99 | DIY | Template | Included |

| Banking assistance | ✅ Deep partnership | ❌ | ❌ | ❌ | ❌ | ✅ Mercury |

| Tax consultation | ✅ 15‑min free | Add‑on | Add‑on | ❌ | ❌ | ❌ |

| Bookkeeping | Optional upgrade | Add‑on | Add‑on | ❌ | Add‑on | ❌ |

| Annual report | Reminder + assist | Add‑on | Add‑on | DIY | Add‑on | ❌ |

| Actual first‑year cost | $297 | $477 | $418 | $350+ | $418+ | $500 |

| Processing time | 7–10 days | 20 business days | 1–2 days | 5–7 days | 3–5 days | 7–14 days |

| International support | ⭐⭐⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐⭐ |

| States supported | All 50 | All 50 | All 50 | All 50 | All 50 | Delaware only |

| Entity types | LLC/C‑Corp | LLC/C‑Corp/S‑Corp | LLC/C‑Corp | LLC/C‑Corp | LLC/C‑Corp/S‑Corp | C‑Corp only |

| Best for | 🏆 International founders | US domestic businesses | Budget‑focused | Privacy seekers | US domestic businesses | Funding‑focused startups |

Detailed reviews

Doola ⭐ llcclass top recommendation

- ✅ 100% focused on international founders

- ✅ EIN application without SSN via IRS fax

- ✅ Deep banking partnerships (Mercury, Wise)

- ✅ True one‑stop service

- ✅ YC backed; founders from 175+ countries

- ❌ Higher than DIY (but excellent value)

- ✅ Largest US brand, strong credibility

- ✅ Comprehensive services (paid add‑ons)

- ❌ Primarily for US customers

- ❌ Poor international support

- ❌ Long processing time (20 business days)

- ❌ Hidden costs

ZenBusiness

- ✅ Low base package price

- ✅ Fast processing (1–2 days)

- ❌ Nearly all services are add‑ons

- ❌ Actual cost higher than Doola

- ❌ Banking assistance DIY

- ❌ Average international support

Northwest Registered Agent

- ✅ Strong registered agent service

- ✅ Good privacy protection

- ✅ No hidden fees

- ❌ No EIN application

- ❌ No banking assistance

- ❌ No tax/bookkeeping services

- ❌ Must piece together multiple vendors

Incfile

- ✅ Free base package

- ✅ Relatively fast processing

- ❌ Registered agent extra fee

- ❌ EIN DIY

- ❌ Not friendly for international founders

- ❌ Inconsistent support quality

Stripe Atlas

- ✅ Official Stripe service

- ✅ Stripe account auto‑enabled

- ✅ Includes Mercury account

- ❌ Delaware C‑Corp only

- ❌ Not ideal for e‑commerce/service businesses

- ❌ Expensive ($500)

- ❌ No ongoing tax/compliance support

llcclass recommendation: For most AI‑era solo founders and one‑person companies, Doola is the most reasonable choice. It lets you focus on product and customers instead of paperwork.

Step Two: Choosing the Right "Guide"—Why I Chose Doola

At llcclass, we only recommend tools we've personally verified and that are truly designed for international founders.

There are countless LLC registration services, but most (like LegalZoom, ZenBusiness, Incfile) are designed for US domestic small business owners. They "also support" international clients, but you'll find:

- Customer service doesn't understand non-residents' unique needs

- The EIN application process is complex (they assume you have an SSN)

- Bank account opening is entirely up to you

- Tax consulting mainly focuses on US tax law

This is why I chose Doola the only LLC registration service 100% focused on serving international founders.

Doola's Core Advantages

1. Process Optimized for Non-US Residents

Doola has served only international clients from day one. This means:

- No SSN required to apply for EIN—they have a dedicated IRS fax process

- Customer service team understands every pain point of non-residents

- All documents and forms pre-consider international client situations

- Supports founders from 175+ countries with rich experience

2. True One-Stop Service Loop

From company registration to daily operations, Doola covers everything:

Registration Phase:

- LLC or C-Corp registration (all states available)

- Preparation and submission of Articles of Organization

- EIN tax number application (2-4 weeks)

- Drafting Operating Agreement

- Registered Agent service

- US business address

Ongoing Operations:

- Bank account opening assistance (deep partnerships with Mercury, Wise)

- Free 15-minute consultation

- Annual report filing reminders

- Compliance monitoring and alerts

- Optional bookkeeping and tax filing services

Comparison: LegalZoom only handles registration, everything else is up to you. ZenBusiness's "one-stop" requires additional fees for each service.

3. International Founder-Friendly Banking Partnerships

This is the most critical advantage. Doola has official partnerships with digital banks like Mercury and Wise:

- Mercury account applications through Doola have higher approval rates

- Faster review process (because Doola prepares all necessary documents in advance)

- If issues arise, Doola can communicate directly with the bank

Real case: Many people register their LLC themselves, then get rejected when opening a Mercury account because documents are incomplete or business description is unclear. Through Doola, these issues are avoided in advance.

4. Transparent Pricing, True Value

Doola's pricing model is very straightforward:

Starter Package - $297/year:

- ✅ Formation Filings (LLC or C-Corp registration)

- ✅ Employer Identification Number (EIN) application

- ✅ Operating Agreement / Corporate Bylaws

- ✅ AI Co-Founder

- ✅ Registered Agent Service

- ✅ Virtual Mailing/Business Address

- ✅ Email Support

- ✅ Free 15-minute consultation

- ✅ Compliance reminders

Note: Higher-tier packages (Essential $597/year, Total Compliance $1,999/year) include additional services such as bookkeeping software, unlimited consultations, state report preparation, and complete tax filing services.

Essential Package - $597/year:

- All Starter contents

- ✅ Bookkeeping software (QuickBooks integration)

- ✅ Unlimited CPA consultations

- ✅ State report preparation

Total Compliance Package - $1,999/year:

- All Essential contents

- ✅ Complete IRS tax filing

- ✅ Dedicated accountant

- ✅ Annual report preparation and filing

Comparison with Other Providers:

| Comparison Item | Doola | LegalZoom | ZenBusiness | Northwest | Incfile | Stripe Atlas |

|---|---|---|---|---|---|---|

| Base Filing Fee | $297/yr | $0-79 | $0-49 | $225 | $0-299 | $500 |

| Registered Agent (1st yr) | Included | Free (then $299/yr) | $199/yr | $125/yr | $119/yr | Included |

| EIN Application | Included | $79 | $70 | DIY | DIY | Included |

| Operating Agreement | Included | $99 | $99 | DIY | Template | Included |

| Bank Opening Assist | ✅ Deep Partnership | ❌ | ❌ | ❌ | ❌ | ✅ Mercury |

| Tax Consult | ✅ 15min Free | Purchase | Purchase | ❌ | ❌ | ❌ |

| Bookkeeping | Optional | Purchase | Purchase | ❌ | Purchase | ❌ |

| Annual Report | Reminder+Assist | Purchase | Purchase | DIY | Purchase | ❌ |

| Actual 1st Year Cost | $297 | $477 | $418 | $350+ | $418+ | $500 |

| Processing Time | 7-10 days | 20 biz days | 1-2 days | 5-7 days | 3-5 days | 7-14 days |

| Int'l Support | ⭐⭐⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐ | ⭐⭐⭐⭐ |

| Supported States | All 50 | All 50 | All 50 | All 50 | All 50 | Delaware only |

| Entity Type | LLC/C-Corp | LLC/C-Corp/S-Corp | LLC/C-Corp | LLC/C-Corp | LLC/C-Corp/S-Corp | C-Corp only |

| Best For | 🏆 Int'l Founders | US Locals | Budget Conscious | Privacy Focus | US Locals | Funded Startups |

Detailed Reviews

Doola ⭐ llcclass Top Pick

- ✅ 100% focused on international founders

- ✅ EIN application without SSN

- ✅ Deep partnership with Mercury and other banks

- ✅ True one-stop service

- ✅ YC backed, clients from 175+ countries

- ❌ Price higher than DIY (but worth it)

- ✅ Biggest US brand, good reputation

- ✅ Comprehensive services (extra cost)

- ❌ Mainly for US customers

- ❌ Poor international support

- ❌ Long processing time (20 business days)

- ❌ Many hidden fees

ZenBusiness

- ✅ Low base package price

- ✅ Fast processing (1-2 days)

- ❌ Almost all services require extra purchase

- ❌ Actual cost higher than Doola

- ❌ Bank opening is up to you

- ❌ Average international support

Northwest Registered Agent

- ✅ Professional Registered Agent service

- ✅ Good privacy protection

- ✅ No hidden fees

- ❌ No EIN application

- ❌ No bank opening assistance

- ❌ No tax/bookkeeping services

- ❌ Need to piece together multiple providers

Incfile

- ✅ Free basic package

- ✅ Fast processing

- ❌ Registered Agent costs extra

- ❌ EIN is DIY

- ❌ Unfriendly to international clients

- ❌ Inconsistent customer service

Stripe Atlas

- ✅ Official Stripe service

- ✅ Auto-open Stripe account

- ✅ Includes Mercury bank account

- ❌ Only supports Delaware C-Corp

- ❌ Not suitable for e-commerce/service businesses

- ❌ High price ($500)

- ❌ No ongoing tax/compliance support

5. Y Combinator-Backed Credibility

Doola received investment from Y Combinator, the world's top startup accelerator. YC only invests in companies it believes can change the world.

Currently, Doola has served tens of thousands of founders from 175+ countries, with a TrustPilot rating of 4.8/5 (over 1,000 reviews).

6. Fast Processing, Doesn't Waste Your Time

As a solo entrepreneur running a one-person company, time is money.

- Doola standard processing time: 7-10 business days

- LegalZoom standard processing time: 20 business days

- ZenBusiness is fast (1-2 days), but subsequent EIN application and bank opening are entirely up to you, potentially taking weeks

Doola's end-to-end time (from registration to bank account): about 6-8 weeks, including:

- Company registration: 7-10 days

- EIN application: 2-4 weeks

- Mercury account opening: 1-2 weeks

This is the fastest overall speed international founders can get in the market.

Why Not Choose Other Service Providers?

- LegalZoom: The biggest US brand, but completely targeted at US customers. International clients encounter countless obstacles, customer service often doesn't understand your questions.

- ZenBusiness: Attractive pricing but many hidden fees. Basic package $0-49, but actual use requires purchasing almost all services separately, ultimately more expensive than Doola.

- Stripe Atlas: Only supports Delaware C-Corp (not suitable for small e-commerce or service businesses), price $500, no ongoing support.

- Northwest Registered Agent: Great registered agent service, but doesn't provide bookkeeping, tax, and other ongoing services—you need to find multiple providers yourself.

- DIY registration: Seems cheapest, but you need to: research each state's laws, apply for EIN yourself (very complex), find registered agent yourself, figure out bank opening yourself, learn tax filing yourself. Unless you have lots of time and enjoy learning US company law, not recommended.

llcclass recommendation: For the vast majority of AI-era solo entrepreneurs and one-person companies, Doola is the only reasonable choice. It lets you focus on products and customers, not get buried in paperwork.

Most importantly, as a llcclass.com reader, I've secured exclusive discounts for you!

Step Three: [Take Action Now] Use My Exclusive Link and Code to Start Registration!

Today (October 21, 2025), as the founder of llcclass, I will officially begin my own US LLC registration process.

I'll walk this path with real money and document every step, every detail, every problem encountered on llcclass.com.

This isn't armchair theory—this is a real entrepreneurial journal.

Now, let's start this journey together.

👉 Doola 👈

Doola

Real User Feedback

Trusted by Thousands of International Entrepreneurs

Entrepreneurs from 175+ countries trust Doola

TrustPilot Rating: ⭐⭐⭐⭐⭐ 4.8/5 (Over 1,000 reviews)

DoolaHow to Use the Discount Code

- Step 1: Click the link above to go to Doola's website

- Step 2: Select the Starter package ($297/year)—sufficient for most people

3. Step 3: In the checkout page "Promo Code" field, enter: LLCCLASS10 - Step 4: Click "Apply," and the price will drop from $297 to $267

- Step 5: Complete registration information and start your LLC journey!

The $30 saved, plus the later Mercury $250 cashback, will bring your net cost down to just $17 (excluding state fees)!

📋 Not sure how to fill it out? Check → Doola Registration Step-by-Step Guide ← We walk you through every step!

What's Included in Doola Starter Package? (Complete List)

Let me detail all the value you get for $267 (after discount code):

Starter Package ($297/year) includes:

- ✅ Formation Filings - LLC or C-Corp registration (any state available), Articles of Organization preparation and filing, State government registration fee (included), Processing time: 7-10 business days

- ✅ Employer Identification Number (EIN) - Application handled via IRS fax process for non-SSN holders, Usually completed in 2-4 weeks

- ✅ Operating Agreement / Corporate Bylaws - Drafted by professional lawyers, Defines member rights and responsibilities, Required document for bank opening

- ✅ AI Co-Founder - AI-powered business guidance and support

- ✅ Registered Agent Service - Receives all official legal documents, Compliance reminders and forwarding, Independent value $149/year

- ✅ Virtual Mailing/Business Address - Used for company registration, Used to receive mail, Enhances business credibility

- ✅ Email Support - Direct email support for your questions

- ✅ Free 15-minute consultation - Understand your tax obligations, LLC vs C-Corp advice, US tax vs home country tax planning

- ✅ Bank account opening assistance - Official partnerships with Mercury, Wise, etc., All necessary documents prepared in advance, Increases account opening success rate

- ✅ Compliance reminders - Annual report filing reminders, Compliance monitoring and alerts

Note: Higher-tier packages include additional services:

- Essential Package ($597/year): Includes all Starter features + Bookkeeping software (QuickBooks integration) + Unlimited consultations + State report preparation

- Total Compliance Package ($1,999/year): Includes all Essential features + Complete IRS tax filing + Dedicated accountant + Annual report preparation and filing

Ongoing Services (included first year):

- ✅ Compliance calendar and reminders

- Annual report deadlines

- Tax filing deadlines

- License renewal reminders

- ✅ Status monitoring

- Ensures your LLC stays in "good standing"

- Avoids administrative dissolution

- ✅ Document storage

- Secure storage of all company documents

- Online access anytime

Total Market Value Estimate:

- Lawyer registration service: $500-1,000

- EIN application service: $50-150

- Registered Agent first year: $149

- Operating Agreement: $99-300

- Tax consultation: $150-300

- Total market value: $948-1,899

Your actual payment (using LLCCLASS10): $267

Value proposition: Save 72-86%!

I've already placed my order. Over the coming weeks, I'll update in real-time on llcclass.com:

- Progress on Doola processing my documents

- Detailed EIN application process

- Any problems encountered and solutions

- Experience interacting with Doola customer service

- Actual timeline for receiving documents

Follow llcclass.com and witness how a global entrepreneur builds a US company from scratch!

Step Four: Which State Is Best for AI-Era Solo Entrepreneurs?

Choosing a registration state is a question many people struggle with. Let me give you the answer based on data and practical experience.

The Four Most Important Factors for International Founders

As a one-person company or small team, you need to consider:

- Cost: Sum of registration fees, annual fees, and taxes

- Privacy: Whether your personal information will be publicly disclosed

- Compliance difficulty: Whether annual reports, licenses, and other requirements are simple

- Reputation: The state's recognition in the business world

Wyoming - llcclass's Top Recommendation ⭐

Why Wyoming?

Wyoming is called "LLC paradise," designed specifically for small businesses and non-residents:

Cost Advantage (Most Economical):

- Registration fee: $100

- Annual report fee: $60

- State income tax: $0

- Franchise tax: $0

- Annual total cost: only $60

Privacy Protection (Very High):

- LLC member names don't need to be publicly disclosed

- Public records only show registered agent information

- If you value anonymity, this is the best choice

- Protects you from spam and harassment

Asset Protection (Strongest):

- Wyoming has the strongest asset protection laws in the US

- Strict separation of personal property and company debts

- Creditors find it very difficult to "pierce the corporate veil" to pursue personal assets

- Especially important for entrepreneurs testing new ideas

Simple Compliance:

- Annual report is simple, 5-minute online submission

- No audit or complex financial disclosure required

- Doola will remind you and assist with filing

Non-Resident Friendly:

- Clearly welcomes foreign ownership

- No US residency requirement

- No physical office requirement

Suitable for:

- E-commerce sellers (Amazon FBA, Shopify)

- SaaS and software developers

- Freelancers and consultants

- Digital content creators

- AI tool developers

- Any budget-conscious one-person company

llcclass recommendation: For 95% of international founders, Wyoming is the best choice.

Delaware - If You Plan to Raise Funding

Why Is Delaware So Famous?

Delaware isn't the cheapest, but it's the gold standard of US corporate law:

Legal Advantages:

- Has a dedicated business court (Court of Chancery)

- 200+ years of corporate case law, most mature

- Most flexible handling of complex equity structures and preferred stock

- Fastest court resolution of business cases

Investor Preference:

- 90% of VC-backed companies are registered in Delaware

- Investors and lawyers are most familiar with Delaware law

- If you plan Series A, B funding, Delaware makes due diligence simpler

Disadvantages:

- Registration fee: $110

- Annual franchise tax: $300

- Registered Agent fee: extra $50-100/year

- Annual total cost: $450-500

Compliance Requirements:

- Annual report is relatively simple

- But requires paying franchise tax annually (even with no revenue)

Suitable for:

- Startups planning to raise funding within 12-24 months

- High-growth tech companies

- Companies planning future IPOs

- Companies with complex equity structures (multiple founders, option pools, etc.)

llcclass recommendation: Only choose Delaware if you clearly plan to raise funding or go public. For self-sustaining profitable businesses, Delaware's extra costs aren't worth it.

Nevada - Privacy+ But High Cost

Nevada's selling points:

- No state income tax

- High privacy protection (similar to Wyoming)

- No information sharing agreement (doesn't automatically report to IRS)

Disadvantages:

- Registration fee: $75-$425 (depends on authorized capital)

- Annual report fee: $150-$500

- Business license tax: $500 (when revenue exceeds $4 million)

- Annual total cost: $225-925

llcclass recommendation: Nevada's advantages don't justify its much higher cost than Wyoming. Unless you have special needs for "not sharing information with IRS" (but this doesn't mean you can evade taxes!), not recommended.

Ohio - Ultra-Budget Option

Ohio characteristics:

- Registration fee: $99

- Annual report fee: $0 (yes, zero!)

- Relatively simple compliance requirements

Disadvantages:

- Lower visibility

- Average privacy protection (member information public)

- Has state income tax (but non-residents with no US-sourced income usually don't apply)

llcclass recommendation: If your budget is extremely limited and you don't care about privacy, Ohio is a viable option. But Wyoming's annual fee is only $60 more and provides better privacy and asset protection—better value.

New York, California? Please Avoid!

Some people consider registering in New York or California "for prestige." Please don't do this!

Why?

- California: Minimum annual franchise tax $800 (even with zero revenue!)

- New York: Complex publication requirements (must publish notices in newspapers, costs $500-1,500)

- Both have high compliance costs and complex tax requirements

Unless you must actually operate in these states (have physical office or employees), don't register there.

llcclass Final Recommendation Table

| Your Situation | Recommended State | Annual Cost |

|---|---|---|

| E-commerce, SaaS, freelance, content creation, etc. one-person company | Wyoming | $60 |

| Planning to raise funding within 12-24 months | Delaware | $450-500 |

| Extremely limited budget | Ohio | $0-99 |

| You value privacy and asset protection | Wyoming | $60 |

| You're not sure | Wyoming | $60 |

In the AI age, as a solo entrepreneur, you need low cost, low maintenance, and high flexibility. Wyoming perfectly meets these needs.

Step Five: [Critical Step] "Reimburse" Your Registration Fee with Startup Capital—Mercury $250 Cashback

Once Doola helps us get our EIN (usually 2-4 weeks), the next step is to open a powerful US business bank account.

For AI-era solo entrepreneurs, choosing the right bank is crucial—it's not just a place to keep money, it's your global financial control center.

Why Traditional Banks Don't Work for Us

Traditional US banks (like Chase, Bank of America, Wells Fargo) are nearly impossible for non-residents:

- ❌ Require in-person visit to US branch to open account

- ❌ Need SSN or ITIN

- ❌ High monthly fees ($10-25/month)

- ❌ Minimum deposit requirements ($1,500-5,000)

- ❌ High international wire fees ($25-45/transaction)

- ❌ Ancient technology, no API integration

- ❌ Customer service unfriendly to international clients

This is why the new generation of digital banks changed the game.

Mercury - The Ideal Bank for AI-Era Solo Entrepreneurs

My top choice is Mercury. Why?

1. Designed Specifically for Tech Entrepreneurs and Digital Businesses

Mercury isn't a traditional bank—it's banking as software.

Founded by former Airbnb employees and backed by A16Z and Coatue, Mercury's mission is "banking for ambitious companies."

Its customers include:

- Thousands of YC-incubated startups

- SaaS and software companies

- E-commerce and DTC brands

- Agencies and consulting firms

- AI tool developers

If you're a one-person company with big dreams, Mercury is designed for you.

2. 100% Remote Account Opening, Welcomes Non-US Residents

Mercury explicitly supports international founders:

- ✅ Completely online account opening, 10-15 minutes

- ✅ No SSN or ITIN required

- ✅ No need to visit the US

- ✅ Supports companies registered in:

- United States (all 50 states)

- British Virgin Islands

- Cayman Islands

- UAE

- Bahamas

- Bermuda

- Singapore

- Jersey

However, residents of some countries don't qualify. Mercury will tell you if you're eligible when you apply.

3. Zero Monthly Fees, No Minimum Deposit

Completely free:

- No monthly maintenance fees

- No minimum deposit requirement

- No hidden fees

- No account inactivity fees

You can keep $0 in the account and won't be charged.

4. Powerful International Transfer Capabilities

This is the most important feature for international founders:

USD International Wires:

- Completely free (standard SHA mode)

- Optional $15 OUR mode (Mercury covers all intermediary bank fees, ensures recipient gets full amount)

- Usually arrives in 1-3 business days

Non-USD International Wires:

- Supports 30+ currencies

- Only charges 1% transparent currency conversion fee

- Much lower than traditional banks' 3-5% rates

ACH and Wire Receiving:

- Free to receive US domestic ACH transfers

- Free to receive wire transfers

Comparison with Traditional Banks:

- Chase international wire: $40-50/transaction + 3% exchange rate markup

- Bank of America international wire: $45/transaction + 2-3% exchange rate markup

- Mercury: free + 1% exchange fee

Real case: If you receive $10,000 monthly from US clients and transfer to home country:

- Traditional bank cost: $45 fee + $300 exchange markup = $345/month

- Mercury cost: $0 fee + $100 exchange fee = $100/month

- Save $245/month, $2,940/year!

5. Virtual and Physical Visa Debit Cards

Provided for free:

- 1 physical Visa debit card (free shipping worldwide)

- Unlimited virtual cards (for subscriptions and online payments)

- Each card can have spending limits

- Real-time transaction notifications

- Can freeze/unfreeze individual cards

Use cases:

- Physical card: ATM withdrawals (note ATM operator fees)

- Virtual card 1: Subscribe to OpenAI API

- Virtual card 2: Subscribe to Google Ads

- Virtual card 3: Subscribe to AWS

Each card tracked separately, finances clear.

6. Modern Financial Tools

Mercury isn't just a bank account—it's your financial operating system:

Multi-Account Management:

- Checking account: daily operations

- Savings account: idle funds earn interest (currently about 4-5% APY)

- Vault account: reserve for taxes or emergency funds

Accounting Software Integration:

- QuickBooks

- Xero

- FreshBooks

- Auto-sync transactions, simplifies bookkeeping

Team Collaboration:

- Add team members (virtual assistants, accountants)

- Set different permission levels

- Issue cards and spending limits to employees

API and Automation:

- Powerful API for automated payments

- Webhooks for real-time notifications

- Perfect for SaaS and subscription businesses

Financial Insights:

- Real-time cash flow dashboard

- Categorized transaction tracking

- Custom tags and notes

- Export reports

7. Security and Protection

FDIC Insurance:

- Deposits protected by FDIC up to $250,000

- Mercury partners with Choice Financial Group and Evolve Bank & Trust

- Your money is as safe as in traditional banks

Security Measures:

- 2FA two-factor authentication

- Biometric login

- Real-time fraud detection

- Automatic alerts for suspicious activity

8. Official Rewards Policy: $250 Bonus

Mercury offers an official rewards policy for new account holders: after opening an account through the link below, if you deposit and maintain at least $10,000 USD within 90 days of account opening (held continuously for at least one business day), you'll receive a $250 USD bonus.

👉 Register for free Mercury bank account (Prepare for $250 bonus!) 👈

Note: Must register through the above link, otherwise you can't enjoy this policy.

Additionally, I'll share a detailed article about Mercury Bank and my complete account opening process: 3-Hour Mercury Account Opening Record

Is $10,000 a Lot of Money?

For a formally launched business, $10,000 is a reasonable and recommended operating capital reserve:

- Covers 2-3 months of basic operating costs

- Handles unexpected expenses (server downtime, ad testing, etc.)

- Demonstrates business seriousness (to suppliers, partners)

- Provides buffer for expansion

If you truly don't have $10,000 yet:

- Open the account first (Mercury itself is free)

- Wait for business to generate cash flow

- When you accumulate $10,000, deposit it

- As long as you reach it within 90 days of opening, you can get the bonus

Mercury Account Opening Required Documents (Preparation Checklist)

Preparing these materials in advance can greatly speed up the review:

Company Documents (Doola will provide):

- ✅ Articles of Organization

- ✅ EIN confirmation letter (SS-4 or CP-575 form)

- ✅ Operating Agreement

- ✅ US business address proof

Personal Identity:

- ✅ Passport or ID of all beneficial owners (holding 25%+)

- ✅ Address proof for non-US residents (utility bills, bank statements, etc., within 3 months)

- ✅ Selfie photo or video verification (KYC process)

Business Information:

- ✅ Business description: what you do, how you make money

- ✅ Website or product link (if available)

- ✅ Expected monthly transaction volume

- ✅ Source of funds explanation

Professional Advice:

-

Build a professional website: Even a simple one-page site with clear Terms of Service, Privacy Policy, and Refund Policy will greatly improve approval rates.

-

Prepare complete documents: Some banks require notarized or certified copies of registration documents. Documents provided by Doola are usually sufficient, but prepare notarized copies just in case.

-

Clear business description: Avoid vague expressions. "We provide AI-powered customer service chatbot SaaS solutions for small businesses" is much better than "we do software."

-

Start with advanced KYC: Mercury has an option to complete advanced identity verification upfront, which can streamline the review process.

-

Be patient: Mercury's review usually takes 1-2 weeks. Don't send multiple emails during this period, it might backfire.

What If Mercury Rejects You?

Although the success rate through Doola is high, Mercury does reject some applications.

Common rejection reasons:

- High-risk business type (cryptocurrency, adult content, etc.)

- Applicant from restricted country

- Incomplete or unclear documents

- Unclear business model description

- KYC verification failed

Alternative solutions:

Wise Business (formerly TransferWise):

- Very friendly to international founders

- Supports 50+ currencies

- Low-rate international transfers

- But not a true US bank (it's an e-money account)

- May not be accepted by all payment processors

Relay:

- Modern bank similar to Mercury

- Offers up to 20 free checking accounts

- Slightly lower acceptance of non-residents

Brex:

- Focuses on startups

- Offers credit cards (no personal guarantee required)

- But has certain revenue and funding requirements

llcclass recommendation: First choice Mercury. If rejected, try Wise. Before applying to Mercury, ensure your business complies with their terms of service.

Mercury vs Other Digital Banks

| Feature | Mercury | Wise Business | Relay | Traditional Bank |

|---|---|---|---|---|

| Monthly fee | $0 | $0 | $0 | $10-25 |

| Minimum deposit | $0 | $0 | $0 | $1,500+ |

| Non-US resident opening | ✅ Yes | ✅ Yes | ⚠️ Difficult | ❌ Nearly impossible |

| USD international wire | Free | $4.14 | $10 | $40-50 |

| Currency conversion fee | 1% | 0.41% | N/A | 3-5% |

| API integration | ✅ Powerful | ✅ Yes | ✅ Yes | ❌ No |

| Accounting software integration | ✅ Yes | ✅ Yes | ✅ Yes | ⚠️ Limited |

| Savings account interest | ~4-5% | ~3-4% | ~4% | <1% |

| FDIC insurance | ✅ $250k | ❌ (FCA protected) | ✅ $250k | ✅ $250k |

| Best for | Tech/SaaS/E-commerce | High-frequency international transfers | Multi-account needs | Traditional business |

For AI-era solo entrepreneurs, Mercury is the best all-around choice.

Step Six: [Do the Math] Final Cost Only $17 (excluding state fees)!

Now, let's calculate in detail what your real cost is with llcclass's strategy.

Simplified Cost Calculation

Yes, for just $17 (excluding state fees), you get:

- ✅ A legitimate US LLC

- ✅ EIN tax number

- ✅ US business address

- ✅ Registered Agent service (first year)

- ✅ Operating Agreement

- ✅ US bank account

- ✅ Ability to access Stripe/PayPal

- ✅ Tax consultation (30 minutes)

Complete Cost Breakdown (First Year, Wyoming Example)

Let's look more detailed:

Direct Costs:

Savings: $681-1,532 (72-85% discount)

Subsequent Cashback:

| Item | Amount | Timing |

|---|---|---|

| Mercury bonus | $250 | 5 weeks after meeting conditions |

Net Cost:

| Amount | |

|---|---|

| Doola payment | $267 |

| Mercury cashback | -$250 |

| First year net cost | $17 (excluding state fees) |

Second Year and Beyond Annual Costs

| Fee Item | Option A (Renew Doola) | Option B (Don't Renew Doola) |

|---|---|---|

| Doola annual fee | $297 | $0 |

| Wyoming annual report | Included in Doola | $60 |

| Registered Agent | Included in Doola | $100-150 |

| Compliance reminders | Included in Doola | Remember yourself |

| Tax support | Included in Doola | Handle yourself or find CPA |

| Mercury account | $0 | $0 |

| Annual total cost | $297 | $160-210 |

llcclass recommendation:

- First year: Must use Doola because setup process is complex.

- Second year onward:

- If your business is profitable, renewing at $297 for continued support, compliance reminders, and tax consulting is very worthwhile

- If your budget is extremely tight and you have time to learn yourself, you can not renew, handle the $60 annual report and $100-150 registered agent yourself

Cost Comparison with Other Options

Option 1: DIY self-registration

- Wyoming state fee: $100

- Registered Agent first year: $149

- EIN application: figure it out yourself (huge time cost)

- Bank opening: figure it out yourself (may fail multiple times)

- Money cost: $249

- Time cost: 50-100 hours research and trial/error

- Risk: High, easy to make mistakes

Option 2: Using LegalZoom

- Basic package: $79

- State fee: $100

- Registered Agent: free first year, $299 second year

- EIN application: $79

- Operating Agreement: $99

- Bank opening: completely on your own

- First year cost: $357

- Second year onward: $299/year

- International support: Poor

Option 3: Using ZenBusiness

- Basic package: $49

- State fee: $100

- Registered Agent: $199/year

- EIN application: $70

- Operating Agreement: $99

- Bank opening: completely on your own

- First year cost: $517

- Second year onward: $199/year

- International support: Average

Option 4: llcclass recommendation (Doola + Mercury)

- Doola Starter: $297

- LLCCLASS10 discount: -$30 - Mercury cashback: -$250

- First year net cost: $17 (excluding state fees)

- Second year onward: $297 (if renewed)

- International support: Excellent

- Services included: Most comprehensive

Conclusion: llcclass's solution not only has the lowest cost but also the most comprehensive services, most suitable for international founders.

The Real Meaning of $17 (excluding state fees)

Let's put this number in perspective:

$17 (excluding state fees) is equivalent to:

- 3-4 cups of coffee at Starbucks

- Two months of Netflix subscription

- One takeout dinner

- Less than one month of ChatGPT Plus subscription

$17 (excluding state fees) gives you:

- The key to the world's largest market

- Ability to use top tools like Stripe, PayPal

- Business credibility as a "US company"

- Foundation that could generate tens or hundreds of thousands of dollars annually in the future

This might be the highest ROI $17 (excluding state fees) investment of your life.

Step Seven: Unlock the US Payment Ecosystem - Stripe & PayPal

With a US LLC and bank account, you can finally apply for those top payment processors that once said "no" to you!

This is the most exciting moment of the entire journey—you can finally accept payments from global customers just like US entrepreneurs.

Why Are Payment Processors So Important?

In the AI age, your product might be:

- SaaS subscription service

- Online courses or memberships

- Digital downloads (ebooks, templates, images)

- Consulting or freelance services

- E-commerce products

- AI tools or API services

All of these need a reliable way to receive customer payments.

And Stripe and PayPal are the world's most trusted, most widely used payment solutions.

Stripe - The Gold Standard for Developers and SaaS

Why Is Stripe the Top Choice for AI-Era Solo Entrepreneurs?

Stripe is called "the AWS of payments"—powerful, flexible, developer-friendly.

Millions of businesses worldwide use Stripe, including:

- Shopify

- Lyft

- Instacart

- Slack

- Notion

- Countless SaaS and digital product entrepreneurs

Core Advantages

1. Explicitly Supports Foreign-Owned US LLCs

This is most critical: Stripe explicitly allows non-US residents to apply for accounts through their US LLCs.

As long as you have:

- ✅ Legitimate US LLC

- ✅ EIN tax number

- ✅ US bank account

- ✅ US business address

- ✅ Valid business website

You fully qualify for a Stripe US account!

2. Powerful and Flexible API

Stripe isn't just a payment button—it's a complete payment infrastructure:

- Payment Links: No coding needed, create payment links to share with customers

- Checkout: Hosted checkout page, integrate in minutes

- Payment Intents API: Fully customized payment flows

- Subscriptions: Automated subscription billing and management

- Connect: Build marketplaces or platforms (like Uber/Airbnb model)

- Billing: Invoices, quotes, payment reminders

3. Global Coverage

- Available in 46 countries (including US)

- Supports 135+ currencies

- Customers can pay in local currency, automatically converts to USD

- Supports all major credit cards and payment methods globally

4. Advanced Features

- Radar: Machine learning-based fraud detection, automatically blocks 99.9% of fraudulent transactions

- Disputes: Automated dispute handling

- Tax: Automatically calculates global sales tax

- Sigma: SQL query your payment data

- Terminal: If you need physical store POS

5. International Business Friendly

- Supports global bank account payments

- SEPA, ACH, Wire, Alipay, WeChat Pay, and many payment methods

- Multi-currency settlement

- Strong documentation and 24/7 support

Stripe Fee Structure

Standard Transactions:

- 2.9% + $0.30 per successful transaction

- No setup fees

- No monthly fees

- No hidden fees

International Cards:

- Additional 1% fee (total 3.9% + $0.30)

Currency Conversion:

- 1% (if customer pays in non-USD currency)

Failed or Disputed:

- Dispute fee: $15 (refunded if you win the dispute)

Withdrawal to Bank:

- To Mercury account: free

- Usually arrives in 2 business days

Real Cost Calculation:

Assume your SaaS product monthly subscription is $99, customer in US:

- Stripe fee: $99 × 2.9% + $0.30 = $3.17

- You receive: $95.83

- Effective rate: 3.2%

Assume customer in Europe, pays in euros:

- Stripe fee: $99 × 3.9% + $0.30 + 1% exchange = $4.86 + $0.99 = $5.85

- You receive: $93.15

- Effective rate: 5.9%

Compared to PayPal (discussed later): PayPal international transaction rate up to 4.49% + $0.49 + 3-4% exchange fee = ~8-9% total rate.

How to Apply for Stripe (Complete Process)

Prerequisites:

- ✅ US LLC registration complete

- ✅ EIN obtained

- ✅ Mercury account opened

- ✅ Professional business website

Step 1: Prepare Documents

Before starting application, ensure you have:

- LLC registration documents (Articles of Organization)

- EIN confirmation letter (CP-575 or SS-4)

- Operating Agreement

- US business address verification

- ID documents of all beneficial owners (25%+ ownership)

- Address proof for non-US residents

- Passport or ID scans

Step 2: Website Preparation

This is a crucial step where many people fail.

Your website must include:

- ✅ Clear product/service description

- ✅ Pricing information

- ✅ Terms of Service

- ✅ Privacy Policy

- ✅ Refund Policy

- ✅ Contact information (email, address)

- ✅ Company information (LLC name, EIN, address)

- ✅ Professional design (doesn't need to be perfect, but can't look like a scam site)

Free resources:

- Use Termly to generate free Terms of Service and Privacy Policy

- Use Shopify policy generator

- If you don't have a website yet, easiest way is to quickly build one with Webflow, Framer, or Carrd

Step 3: Register Stripe Account

- Visit stripe.com

- Click "Start now"

- Select United States as country

- Enter your LLC email address

- Create password

Step 4: Complete Business Information

Stripe will ask you to fill out:

- Business type: select "Company"

- Company structure: select "Limited Liability Company" (LLC)

- LLC name: exactly match registration documents

- EIN: enter your 9-digit EIN number

- Company address: your US business address

- Industry and product description: detailed description of what you do

- Website URL: your business website

Step 5: Personal Identity Verification

As the LLC's beneficial owner, you need to provide:

- Full name (match passport)

- Date of birth

- Personal address (your actual residence address, non-US)

- Passport or ID number

- Upload passport/ID photo

- Selfie photo or video verification (KYC)

Step 6: Bank Account Linking

- Select "Bank account"

- Enter your Mercury routing number

- Enter your Mercury account number

- Stripe will send two small deposits (usually $0.01-0.99) to Mercury for verification

- In 1-2 days, check amounts in Mercury and confirm in Stripe

Step 7: Wait for Review

- Stripe usually reviews your application in 1-3 business days

- During review, you can use "test mode" to test integration

- If Stripe needs additional information, they'll contact you via email

Step 8: Activate and Start Accepting Payments!

Once review is approved:

- You'll receive email notification

- Switch to "Live mode"

- Start accepting real payments!

Common Stripe Application Issues and Solutions

Issue 1: What if I don't have a website?

If your product is a mobile app, or you're still in MVP stage:

- Create a simple landing page

- Use Carrd ($19/year) or Webflow (free) to quickly build

- Just include product description, pricing, and terms

- Even if product isn't launched yet, you can use a "coming soon" page

Issue 2: My website language isn't English

Stripe strongly prefers English websites because the review team mainly speaks English.

Recommendation:

- Provide English version (at least terms and policies should have English)

- Or use Google Translate to create an English copy

- Submit English version URL in Stripe application

Issue 3: Stripe requests additional documents

This is normal. Stripe may request:

- Notarized LLC documents

- Bank statements

- Business plan or cash flow forecast

- Sample supplier/customer contracts

Response: Respond quickly, provide clear documents, appear professional.

Issue 4: Rejected by Stripe

If Stripe rejects your application:

- Ask for specific reason (reply to Stripe's email)

- Fix the issue (supplement documents, update website, etc.)

- Reapply after 30 days

- Consider applying for PayPal as backup

Business types not allowed to use Stripe:

- Adult content or pornography

- Cryptocurrency buying/selling

- Gambling or betting

- Multi-level marketing (MLM)

- Certain high-risk industries

Issue 5: Can I have multiple Stripe accounts?

If you have multiple businesses, each LLC can have its own Stripe account. But you can't open multiple Stripe accounts with one LLC (will be banned).

PayPal Business - The King of Global Recognition

Although Stripe is the technical top choice, PayPal has its unique advantages.

Why Should You Also Consider PayPal?

1. Extremely High Consumer Trust

PayPal was founded in 1998, has over 20 years of history, with 400+ million active users globally.

Many consumers—especially older generations—trust PayPal more than directly entering credit card information.

Real data: Offering PayPal as a payment option can increase conversion rates by 20-30%, especially for first-time buyers.

2. Available in 200+ Countries

Compared to Stripe's 46 countries, PayPal covers almost all global markets.

3. Out-of-the-Box, Zero Coding

PayPal provides simple "Buy Now" buttons and hosted checkout, completely no programming knowledge needed.

If you're not a developer or want to launch quickly, PayPal may be friendlier.

4. Built-in Seller Protection

PayPal provides dispute protection for sellers (under qualifying conditions), especially important for physical goods.

5. Deep Integration with Platforms Like eBay

If you sell on eBay, Etsy, and other platforms, PayPal is the smoothest payment method.

PayPal Fee Structure

Standard Transactions:

- 2.99% + $0.49 per transaction

- Slightly more expensive than Stripe ($0.49 vs $0.30)

International Transactions:

- Additional 1.5% cross-border fee

- Total: 4.49% + $0.49

Currency Conversion:

- 3-4% (much higher than Stripe's 1%)

- This is PayPal's main hidden cost

Withdrawal to Bank:

- To US bank: free

- But to non-US bank: up to $5/transaction

Real Cost Comparison:

Same $99 subscription, US customer:

- PayPal fee: $99 × 2.99% + $0.49 = $3.45

- Stripe fee: $3.17

- PayPal 8.8% more expensive

$99 subscription, European customer:

- PayPal fee: $99 × 4.49% + $0.49 + 3.5% exchange = $4.45 + $3.47 = $7.92

- Stripe fee: $5.85

- PayPal 35.4% more expensive!

Conclusion: For international transactions, Stripe is significantly more cost-effective.

How to Apply for PayPal Business (Simplified Process)

PayPal's application is simpler than Stripe:

Step 1: Register Account

- Visit paypal.com/business

- Click "Sign Up"

- Select "Business Account"

Step 2: Select Account Type

- Select "Company"

- Business type: select "Limited Liability Company"

Step 3: Fill Out Business Information

- LLC name

- US business address

- EIN

- Industry category

- Website URL (optional, but recommended)

Step 4: Personal Information

- As business owner, provide your personal information

- Name, date of birth, SSN/ITIN or passport number

- Personal address (actual residence)

Step 5: Link Bank Account

- Add your Mercury bank account

- PayPal will send two small deposits for verification

- Confirm amounts to complete verification

Step 6: Verify Identity

- Upload passport or ID

- May need to provide LLC documents and EIN confirmation letter

- Wait for review (usually 1-3 business days)

Step 7: Start Accepting Payments!

- After review approval, create payment buttons or invoices

- Start accepting PayPal and credit card payments

Some Considerations About PayPal

1. Risk of Funds Freezing

PayPal is known for "preventive freezing" of accounts, especially for new accounts or sudden large transactions.

How to avoid:

- Gradually increase transaction volume (don't make first transaction $10,000)

- Maintain low dispute rate

- Respond quickly to customer issues

- Keep shipping proof and customer communication records

2. Withdrawal Fees

Withdrawing from PayPal to non-US banks may incur $5/transaction fee.

Solution: Withdraw to Mercury (free), then transfer from Mercury to home country.

3. Poor Customer Service

Compared to Stripe's responsive support, PayPal's customer service is often criticized.

Stripe vs PayPal: Which Should You Choose?

| Comparison Dimension | Stripe | PayPal |

|---|---|---|

| Transaction rate (US) | 2.9% + $0.30 | 2.99% + $0.49 |

| International transaction rate | 3.9% + $0.30 | 4.49% + $0.49 |

| Currency conversion fee | 1% | 3-4% |

| Supported countries | 46 | 200+ |

| Supported currencies | 135+ | 25 |

| Technical requirements | Need programming (or use tools) | Zero coding |

| Customer trust | Medium-high | Extremely high |

| Developer friendliness | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ |

| Subscription billing | Native support, powerful | Supported but fewer features |

| Dispute handling | Excellent | Good |

| API functionality | Extremely powerful | Basic |

| Customer service quality | ⭐⭐⭐⭐⭐ | ⭐⭐ |

| Risk of funds freezing | Low | Medium-high |

| Suitable business | SaaS, subscriptions, digital products, modern e-commerce | Small transactions, individual consumers, eBay sellers |

llcclass's Final Recommendation: Use Both!

As an AI-era solo entrepreneur, don't choose, get both!

Strategy:

Primary payment method: Stripe

- Lower rates

- More modern, more powerful

- Better subscription management

- More suitable for SaaS and digital products

Alternative payment method: PayPal

- Increases conversion rate (some people only trust PayPal)

- Covers regions Stripe doesn't support

- Provides more payment flexibility

Implementation:

- On checkout page, provide two options: "Pay with Credit Card" (via Stripe) and "PayPal"

- Most customers will choose Stripe (cheaper rates)

- But 10-20% who prefer PayPal won't be lost

Data support: Offering multiple payment methods can increase overall conversion rates by 15-40%.

Cost:

- Maintaining both Stripe and PayPal accounts simultaneously: $0 (both have no monthly fees)

- Only pay processing fees on actual transactions

How Does a US LLC Make All This Possible?

Let's return to the core question: Why do you need a US LLC to use Stripe and PayPal?

Stripe and PayPal don't require you to be a US citizen, they require you to have a US business entity.

This distinction is crucial:

Stripe/PayPal's logic:

- They are US companies, regulated by US law

- They need to comply with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations

- They need to be able to contact you if there are issues

- They need to ensure tax compliance (1099 reporting, etc.)

A US LLC provides:

- ✅ Legitimate US entity identity

- ✅ EIN tax number (for IRS reporting)

- ✅ US address (legal contact point)

- ✅ US bank account (fund circulation)

- ✅ Traceable registered agent (receives legal documents)

This is why:

- Without LLC: "Sorry, your country isn't supported"

- With LLC: "Welcome! Please start accepting global payments"

Once you cross this threshold, the world becomes completely different.

You transform from "an international freelancer excluded from the system" to "a global player competing equally with US businesses."

This is what llcclass exists for: to help you cross this threshold and gain equal access to the US financial ecosystem.

Step Eight: Tax Obligations - Everything You Need to Know

Taxes are the topic that gives international founders the most headaches, but let me simplify it.

Good news: As a non-US resident owning a US LLC, your tax burden may be much less than you think.

Core Principle: The US Only Taxes "US-Sourced Income"

The basic principle of US tax law: territorial principle.

Only income generated within US borders needs to pay US tax.

What Is "US-Sourced Income"?

- Services provided in the US

- Products sold and delivered in the US

- Rent from US real estate

- Interest or royalties paid by US companies

What Is Not US-Sourced Income?

- Your consulting services provided in Italy (even if client is in US)

- Your products manufactured in China and shipped from China (even if buyer is in US)

- Your software code written in Brazil (even if sold through US LLC)

- Your online course created in Thailand (even if students are in US)

Key point: Income source location is determined by service delivery location or product ownership transfer location, not by customer location.

Tax Treatment for Different Business Types

1. Pure Service Business (Consulting, Freelancing, Design, etc.)

Scenario: You're a web designer living in Berlin, providing design services to US clients through your US LLC.

Tax treatment:

- US tax: $0 (because services provided in Germany)

- German tax: Need to report as self-employment income and pay tax in Germany

- Filing requirement: Still need to file Form 5472 and 1120 to IRS

Rationale: Service income is taxed where services are provided. You work in Berlin, so it's German-sourced income, not US-sourced income.

2. Digital Products Business (SaaS, Online Courses, Ebooks, etc.)

Scenario: You live in Buenos Aires, developed a SaaS tool, selling to global customers through your US LLC.

Tax treatment:

- US tax: $0 (because software developed in Argentina)

- Argentine tax: Need to report and pay tax in Argentina

- Filing requirement: File Form 5472 and 1120 to IRS

Rationale: The "manufacturing location" of digital products is where you created it.

3. E-commerce Business - Complex Situation

This is the most complex scenario.

Scenario A: Products shipped directly from China

- You live in Vietnam

- Products manufactured in China

- Sold through Shopify

- Shipped directly from China to US customers

Tax treatment:

- US tax: Possibly $0 (product ownership transferred in China)

- Vietnamese tax: Report as business income

- But this is a gray area, recommend consulting tax advisor

Scenario B: Amazon FBA

- You live in Brazil

- Products manufactured in China

- Sent to Amazon US warehouse

- Amazon ships from US warehouse

Tax treatment:

- US tax: Need to pay! (because product ownership transferred within US)

- This is considered ECI (Effectively Connected Income)

- Need to file and pay tax like a US company (federal tax + possibly state tax)

Solution:

- For FBA business, consider C-Corp instead of LLC

- C-Corp tax rate 21%, but more deductions

- Can retain profits in company, defer dividend tax

4. Hybrid Business

If you have part US-sourced income, part foreign-sourced income:

- Need to track separately

- Only pay US tax on US-sourced portion

- Remaining portion handled according to residence country tax law

Required Filings (Even If You Don't Owe Tax)

Important: Even if you don't owe any US tax, if your LLC is at least 25% foreign-owned, you must file annually to IRS.

Form 5472:

- "Information Return of a 25% Foreign-Owned U.S. Corporation"

- Reports your LLC's transactions with foreign related parties (i.e., yourself)

- Must file annually

Form 1120:

- Corporate income tax return

- Serves as "cover page" for Form 5472

- Must file even if income is $0

Deadline:

- For LLCs with fiscal year ending December 31: April 15 of following year

- Can apply for 6-month extension to October 15

Consequences of not filing:

- Minimum penalty: $25,000 per form per year

- IRS will track and penalize

- Don't take this risk!

Your Home Country Taxes

Equally important: you also need to report LLC income in your tax residence country.

Each country has different regulations, but general principle:

- Most countries tax "worldwide income"

- Even if LLC is in US, income may need to be taxed in your residence country

- May need to report "Controlled Foreign Corporation" (CFC)

Avoid double taxation:

- US has tax treaties with many countries

- If you paid tax in US, you can usually claim credit in residence country

- But if your LLC income isn't US-sourced (no need to pay US tax), then only pay tax in residence country

Recommendation: Consult tax advisor in your residence country to understand specific filing requirements.

Doola's Tax Support

This is why choosing Doola is wise:

Starter package includes:

- ✅ Free 15-minute consultation

- ✅ Understand your specific tax obligations

- ✅ LLC vs C-Corp advice

- ✅ Form 5472 and 1120 filing guidance

Upgrade options:

- Total Compliance package ($1,999/year): Includes complete Form 5472 and 1120 preparation and filing

- If you don't want to handle taxes yourself, this is the worry-free choice

DIY option:

- If your LLC income is simple (pure services, no US-sourced income), you can learn to file yourself

- Use software like TaxAct or FreeTaxUSA

- But first year recommend finding professional to ensure correct setup

Tax Implications of Referral Cashback (Reminder Again)

Mercury's $250 referral cashback:

- If annual total exceeds $600, Mercury will issue 1099 tax form

- Single $250 usually doesn't trigger

- But this is "other income," needs to be reported on your tax return

- Pay tax according to your residence country tax law

Tax Strategy: Maximize Compliance, Minimize Burden

llcclass's recommendations:

1. Record Everything

- Detailed records of all income and expenses

- Save invoices, contracts, receipts

- Use QuickBooks or Xero for automation

2. Distinguish Income Sources

- If you have US clients, record where services are provided

- If selling products, record where they ship from

3. File on Time

- Set calendar reminders

- Doola will automatically remind you

- Don't procrastinate until last minute

4. Consult Professionals

- First year use Doola's free 15-minute consultation

- If business is complex, consider hiring CPA

- Tax compliance is an investment, not a cost

5. Consider C-Corp (if doing FBA)

- If your main business is Amazon FBA or US domestic e-commerce

- C-Corp may save more on taxes

- Consult Doola before registration

Bottom line: Taxes aren't scary, as long as you understand basic principles and seek professional help. As a non-US resident, your tax burden may be lighter than US residents!

Conclusion: Equal Opportunity Starts Today

If you've read this far, I know you're serious.

You're not just "considering" entrepreneurship—you're ready to take action.

I want to tell you three things:

1. You Deserve This Opportunity

Don't think you don't deserve to enter the global market just because you're not American, not in Silicon Valley, don't have VC connections.

Talent is everywhere, and now opportunity can be everywhere too.

The US LLC + Mercury + Stripe combination has already helped tens of thousands of international founders like you and me compete equally with US domestic businesses.

Your ideas, your skills, your passion—these are the keys to success, not your passport color.

2. The Best Time Is Now

AI is changing everything. ChatGPT, Claude, Midjourney, various automation tools—they enable one person to do what previously required a team.

In this era, solo entrepreneurs and one-person companies are rising.

You don't need to wait for the perfect product, sufficient funding, or a large team.

You just need to start.

Register an LLC today, and in two months you can start accepting payments from global customers.

3. You're Not Fighting Alone

llcclass exists to accompany you on this journey.

- When you're unsure which state to choose, we give you the answer (Wyoming)

- When you don't know which bank, we give you recommendations (Mercury)

- When you're confused about taxes, we give you principles (Form 5472 must be filed)

- When you encounter problems, we share practical experience

Take your first step into the US market today!

Complete Action Checklist (Execute Step by Step)

Step 1: Register LLC (Start Today!)

- Click the Doola link below

- Select Starter package ($297/year)

- Choose state (recommend Wyoming)

4. Enter discount code LLCCLASS10 at checkout - Fill out LLC information (name, business description, etc.)

- Upload identity documents (passport/ID)

- Submit application

- Expected time: 15 minutes

- Expected wait: 7-10 business days to receive registration confirmation

👉 Doola) registration now (Don't forget code LLCCLASS10!)](Doola) 👈

Step 2: Wait for EIN (Prepare Other Things Meanwhile)

Doola will automatically apply for EIN for you, usually takes 2-4 weeks.

While waiting, you can:

- Build or improve your business website

- Prepare Terms of Service, Privacy Policy, Refund Policy

- Plan your product/service pricing

- Design your brand and marketing materials

- Learn Stripe and PayPal integration methods

- Track my progress on llcclass.com, learn from practical experience

Step 3: Apply for Mercury Immediately After Receiving EIN

Once Doola notifies you that EIN is approved:

- Click the Mercury referral link below

- Select "Business Checking"

- Fill out LLC information (name, EIN, address)

- Upload documents (Articles of Organization, EIN confirmation letter, Operating Agreement)

- Complete personal identity verification (KYC)

- Wait for review

- Expected time: 20 minutes to fill out

- Expected wait: 1-2 weeks review

👉 Register for free Mercury bank account (Prepare for $250 bonus!) 👈

Step 4: Deposit Funds After Mercury Account Approved

After Mercury account review passes:

- Get your Mercury account routing number and account number

- Initiate international wire from your local bank

- Deposit $10,000 USD (or deposit in multiple installments, cumulative within 90 days)

- Maintain balance for at least one complete business day

- Expected time: International wire arrives in 1-3 business days

- Expected cashback: Receive $250 within 5 weeks after meeting conditions

Step 5: Apply for Stripe and PayPal

After Mercury account is active, you can finally apply for payment processors:

Stripe:

- Visit stripe.com

- Register US account

- Fill out LLC information and EIN

- Provide website URL

- Link Mercury bank account

- Complete identity verification

- Wait for review (1-3 days)

PayPal Business:

- Visit paypal.com/business

- Register business account

- Fill out LLC information and EIN

- Link Mercury bank account

- Complete verification (1-3 days)

Step 6: Start Accepting Payments, Realize Your Dreams!

Everything is ready, you now have:

- ✅ Legitimate US LLC

- ✅ EIN tax number

- ✅ US bank account

- ✅ Stripe and PayPal accounts

- ✅ Equal competitive standing with US businesses

You can:

- Integrate Stripe checkout on your website

- Accept payments in 135+ currencies globally

- Sell on Amazon as a US seller

- Open stores on Shopify, WooCommerce, and other platforms

- Issue professional invoices for US business clients

- Apply for Shopify Payments, Square, and more tools

- Participate in US affiliate marketing programs

- Expand to markets you never imagined

You've transformed from "excluded" to "global player."

Timeline Summary

From today to fully operational:

| Stage | Time | Cumulative |

|---|---|---|

| Doola LLC registration | 7-10 days | 10 days |

| EIN application | 2-4 weeks | 4-6 weeks |

| Mercury account opening | 1-2 weeks | 5-8 weeks |

| Stripe/PayPal application | 1-3 days | 6-8 weeks |

| Start accepting payments! | ~6-8 weeks |

In less than two months, you can fully enter the US market!

Cost Summary (Emphasize Again)

| Item | Amount |

|---|---|

| Doola Starter | $297 |

| LLCCLASS10 discount | |

| Mercury cashback | -$250 |

| Net cost | $17 (excluding state fees) |