We earn commissions when you shop through the links below.

Contents

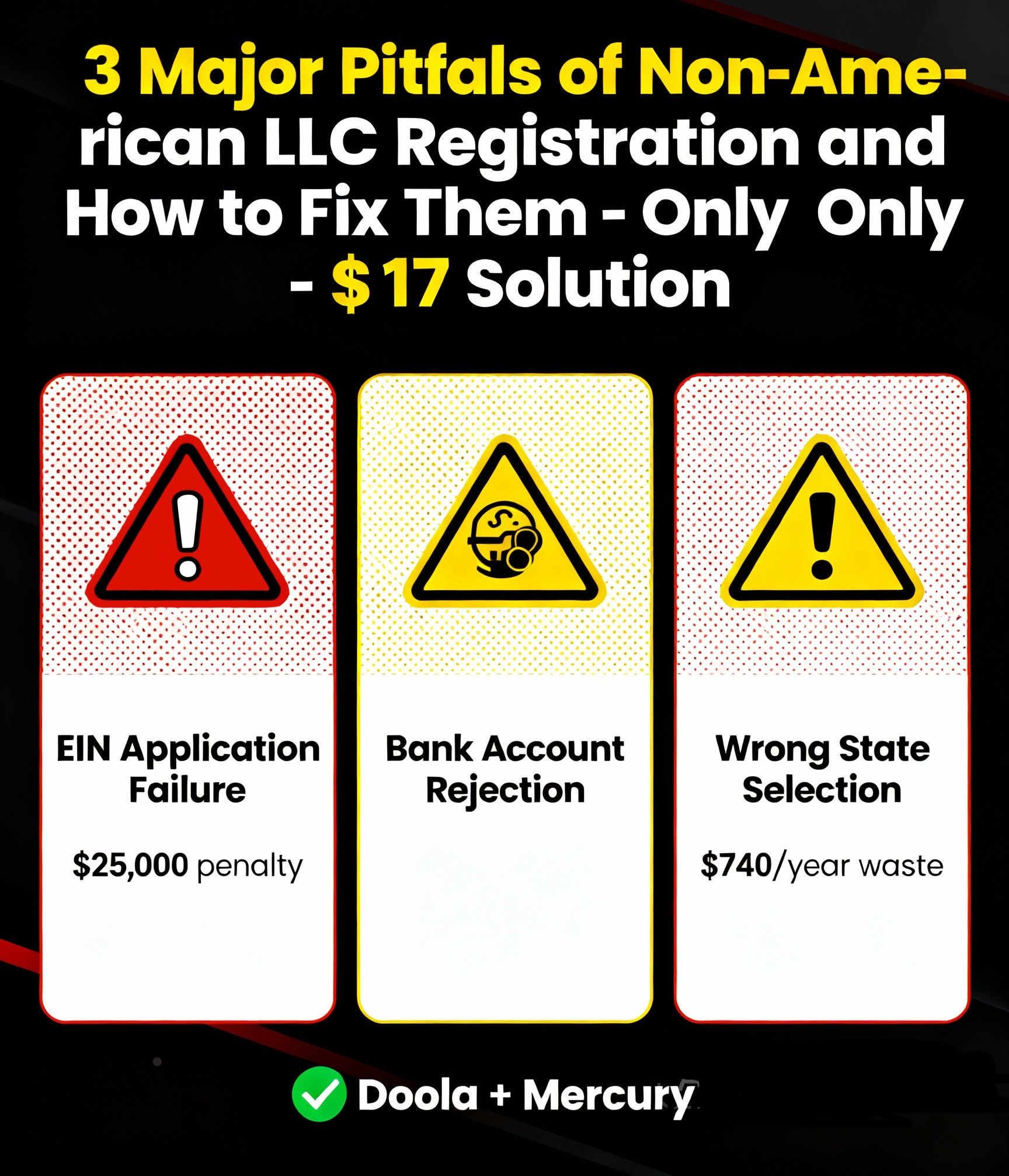

The 3 Big Pitfalls for Non‑US Founders Forming a US LLC — And How to Do It Right (with a $17 Net‑Cost Plan, Tested with Doola/LegalZoom)

Forming an LLC provides entrepreneurs with a flexible business structure that combines the liability protection of a corporation with the tax benefits of a partnership. Whether you're launching a solo venture or partnering with others, understanding the LLC formation process is crucial for protecting your interests.

As a consultant deeply focused on US company formation, I’ve watched too many non‑US entrepreneurs stumble — from multi‑thousand‑dollar penalties to bank account rejections to launch delays. These “tuition fees” are entirely avoidable.

This guide uses a product‑manager mindset and real market data to break down the three most fatal traps and provide proven solutions. Most importantly: how to complete the entire setup at a $17 net cost. This isn’t hype — it’s a practical, repeatable path.

Pitfall #1: EIN Failure Triggers a Compliance Death Spiral — Penalties up to $25,000

The Core Risk: A Tax Compliance Time Bomb

Many think once the LLC is formed, they’re done. In reality, EIN application failure or delay can trigger cascading problems:

Key Facts

- For a foreign‑owned single‑member LLC, the IRS requires Form 5472 within 90 days of formation

- Late filing penalty: $25,000 per form

- Real case: a Shopify launch was delayed by 2 months because an SS‑4 name typo caused EIN rejection

- Another case: “purpose unclear” led to IRS bounce due to missing business plan

Why Do EIN Applications by Non‑US Founders Fail So Often?

Five common fatal mistakes:

Mistake 1: SS‑4 Form Errors

- Leaving SSN/ITIN field blank for responsible party (correct value: "Foreign")

- Company name not matching Articles of Organization exactly (even an extra "The" causes rejection)

- Wrong formation date or misspelled state

Mistake 2: Bad Company Status

- Missed annual report → status becomes Not in Good Standing

- IRS cross‑checks state records; inconsistencies lead to rejection

Mistake 3: Missing Supporting Docs

- No notarized passport copy of responsible party

- Multi‑member LLC can’t prove financial control authority of the applicant

Mistake 4: Wrong Channel

- Non‑US founders cannot apply online; must use fax or mail

- Fuzzy scans or unsigned forms get ignored

Mistake 5: Invalid Addresses

- Using PO Box/virtual addresses → IRS treats as invalid place of business

- CP575 confirmation must be mailed to a real address; email doesn’t work

The Fix: A One‑and‑Done EIN Path

Options (based on real market data)

| Option | Success Rate | Time Cost | Money Cost | Risk |

|---|---|---|---|---|

| DIY | ~60% | 4–8 weeks (multiple bounces likely) | $100 state fee + 50–100 hours | ⚠️ High |

| Fiverr/Upwork agent | Unknown | Unknown | $50–150 | ⚠️ Very high (fake addresses risk) |

| LegalZoom basic | ~70% | ~20 business days | $79 + $100 state + $79 EIN = $258 | ⚠️ Medium (weak international support) |

| Doola Starter | 98%+ | 7–10 business days | $297(−$30 = $267) | ✅ Very low (built for non‑US founders) |

Why Doola achieves 98%+?

- Verified IRS fax channel for applicants without SSN

- Pre‑audit of SS‑4 and state documents for exact consistency

- Real US address + registered agent to avoid virtual address rejections

- Experience from serving founders in 175+ countries

Field Data: With Doola, EIN completes in 2–4 weeks, vs. 4–8 weeks DIY.

Pitfall #2: Bank Account Rejection — The Hidden Gatekeeper

Reality: Without Banking, Your LLC Is a Shell

Even with LLC + EIN, if you can’t open a US bank account you’ll face:

- ❌ No Stripe/PayPal (requires US bank)

- ❌ No Amazon payouts

- ❌ No place for customer payments

- ❌ No way to pay US vendors/ads

Traditional Banks Block Non‑US Founders

Harsh facts

- Must visit a US branch in person (Chase, BoA, Wells Fargo)

- SSN/ITIN required (ITIN needs 4–6 months)

- Monthly fees $10–25; minimum balance $1,500–5,000

- International wires $25–45 + 3–5% FX markup

Real case: tried 3 traditional banks over 2 months — all rejected — company later dissolved.

Digital Banks Also Reject Quietly

Common reasons:

- High‑risk industries (crypto, adult, etc.)

- Restricted countries

- Incomplete docs or unclear business description

- Failed KYC (blurry passport, expired proof of address)

- No professional website (missing ToS/Privacy Policy)

The Fix: Banking That Works

Mercury vs. others

| Feature | Mercury | Wise Business | Relay | Traditional |

|---|---|---|---|---|

| Monthly fee | $0 | $0 | $0 | $10–25 |

| Min balance | $0 | $0 | $0 | $1,500+ |

| Non‑US founder support | ✅ Explicit | ✅ Supported | ⚠️ Hard | ❌ Rare |

| USD international wires | Free | $4.14 | $10 | $40–50 |

| FX conversion | 1% | 0.41% | N/A | 3–5% |

| API | ✅ Strong | ✅ Yes | ✅ Yes | ❌ None |

| FDIC | ✅ $250K | ❌ (FCA) | ✅ $250K | ✅ $250K |

| Success via Doola | 90%+ | ~70% | ~50% | <5% |

Why 90%+ with Mercury via Doola?

- Official partner; all required docs prepared

- Fast‑track review 1–2 weeks (DIY often 3–4 weeks)

- Doola’s Articles & Operating Agreement match Mercury’s standards

Savings Example (monthly USD receipts $10,000 → repatriation):

- Traditional: $45 fee + $300 FX = $345/mo

- Mercury: $0 fee + $100 FX = $100/mo

- Annual saving: $2,940

Pitfall #3: Wrong State Choice — $740+/Year Burn in Hidden Taxes

Core Truth: State Choice Drives Lifetime Cost

Many chase “brand halo” in CA/NY and pay disastrous ongoing costs.

Annual Cost Comparison by State

| State | Filing | Annual | Franchise/Other | Annual Total | Best For |

|---|---|---|---|---|---|

| Wyoming | $100 | $60 | $0 | $60 | ✅ E‑com/SaaS/Freelancers |

| Delaware | $110 | $50 | $300 franchise | $450–500 | VC‑bound tech |

| California | $70 | $20 | $800 franchise min | $820+ | ⚠️ Must operate in CA |

| New York | $200 | $9 | $500–1,500 newspaper publication | $709–1,709 | ⚠️ Must operate in NY |

| Nevada | $75–425 | $150–500 | $500 (revenue >$4M) | $225–925 | Special privacy |

| Ohio | $99 | $0 | $0 | $99 | Extreme low budget |

Takeaways

- CA vs. WY → +$760/year

- Over 10 years → +$7,600

Real “Sunshine Tax” Case

Registered in CA for “brand”; paid $800 even at zero revenue; later fines and CPA costs → $3,500+ loss over 3 years.

Decision Tree: One‑and‑Done State Choice

If you are [E‑com/SaaS/Freelance/Content/AI tools] → Choose Wyoming (annual $60; strongest privacy) If you plan [VC in 12–24 months / IPO someday] → Choose Delaware (annual $450–500; investor friendly) If you have [extremely tight budget AND don’t care about privacy] → Choose Ohio (annual $0–99) If you [must physically operate in CA/NY] → Choose local state and accept high costsllcclass recommendation: For 95% of non‑US founders, Wyoming is the best choice.

The $17 Net‑Cost Full Setup Plan

First‑Year Cost Breakdown (Wyoming example)

Bundle: Doola Starter + Mercury + code LLCCLASS10

Market Prices vs. Doola

- Wyoming state filing: $100 (included in Doola)

- LLC document prep: $200–500 (included)

- EIN application service: $50–150 (included)

- Operating Agreement: $99–300 (included)

- Registered agent (year 1): $149 (included)

- US business address: $100 (included)

- Bank account assistance: $200 (included)

- Tax consult (30 min): $150–300 (included)

Total market value: $948–1,799

Doola price: $297

After LLCCLASS10: $267

Cashback math

- Mercury deposit $10,000 for 1 business day → $250 reward

- Net cost: $267 − $250 = $17

Brutal Comparison vs. Alternatives

| DIY | LegalZoom | ZenBusiness | Doola + Mercury | |

|---|---|---|---|---|

| First‑year cash cost | $249 | $357 | $517 | $17 (after cashback) |

| Time cost | 50–100 hrs | ~20 biz days | Fast but you handle later | 7–10 biz days, end‑to‑end |

| EIN success | ~60% | ~70% | ~70% | 98%+ |

| Banking support | ❌ | ❌ | ❌ | ✅ Official partner channels |

| International support | ❌ | ⚠️ Weak | ⚠️ Average | ✅ Built for non‑US founders |

| Year 2 cost | $160–210 | $299 | $199 | $297 (optional renewal) |

Insights

- Doola + Mercury saves $681–1,532 in year 1

- LegalZoom is roughly 2× slower

- Mercury success is +40% higher via Doola than DIY

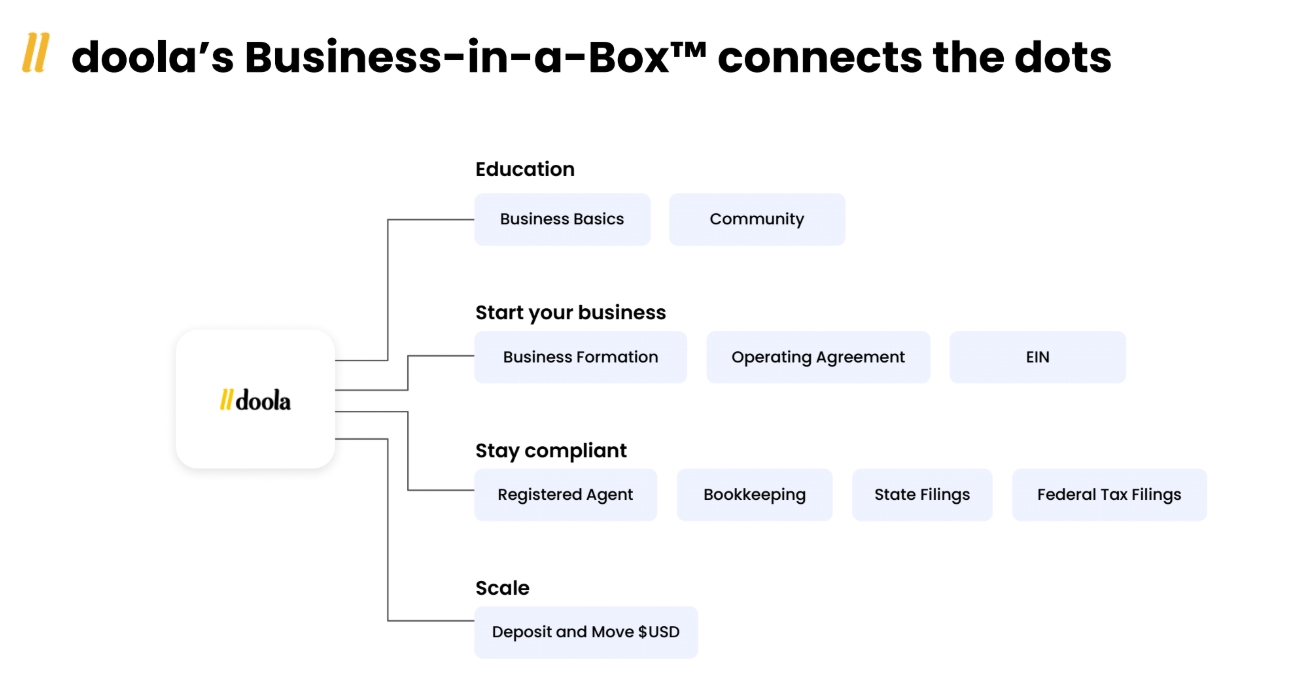

Why Doola?

Doola is designed for non‑US founders and has helped tens of thousands from 175+ countries.

Doola Starter includes

- ✅ Business formation

- ✅ Operating Agreement

- ✅ EIN application

- ✅ Registered agent

- ✅ US business address & virtual mailbox

- ✅ Mercury banking assist

- ✅ Tax consult support

- ✅ Compliance reminders

Exclusive offer: See the $17 plan at /foreigners and use code LLCCLASS10 to save $30.

Customer Feedback

Highlights:

- Trustpilot 4.5★ with 1600+ reviews

- Praised for professionalism, speed, ease of use

- Especially suitable for non‑US founders

- End‑to‑end support from formation to banking

Year 2 and Beyond

Option A (renew Doola): $297/year including annual report, registered agent, compliance reminders, tax support → $297 total

Option B (no renewal): Annual report $60 + registered agent $100–150, self‑manage compliance/taxes → $160–210 total

Recommendation

- Year 1: use Doola (setup is complex)

- Year 2+: renew if profitable for ongoing support; if extremely budget‑constrained and willing to DIY, you can self‑manage

7‑Day Action Plan

Day 1–2: Sign up for Doola Starter via the link and apply code LLCCLASS10

Day 3–5: Doola prepares filings; gather Mercury docs (passport, address proof, business description)

Day 7–17: LLC formed; receive Articles of Organization

Day 18–35: EIN via IRS fax channel (2–4 weeks)

Day 36–40: Apply for Mercury via Doola’s link

Day 41–50: Mercury approved (1–2 weeks); start receiving payments

Day 51–90: Deposit $10,000; hold 1 business day → $250 reward

Total time: 6–8 weeks to full operation

Why llcclass.com?

Our mission:

- ✅ Data‑driven decisions (no hype)

- ✅ Transparent end‑to‑end costs, time, risks

- ✅ Built for non‑US founders

- ✅ Continuously tested and updated

See the $17 plan at /foreigners:

- Code LLCCLASS10 (save $30)

- Mercury banking guide

- Wyoming LLC case study

- Non‑US tax compliance guide

In the AI era, one person can be a company. Don’t let geography limit your potential.

Start now — unlock the US market with just $17 net cost.

Written with November 2025 data; prices/policies follow official updates.

*